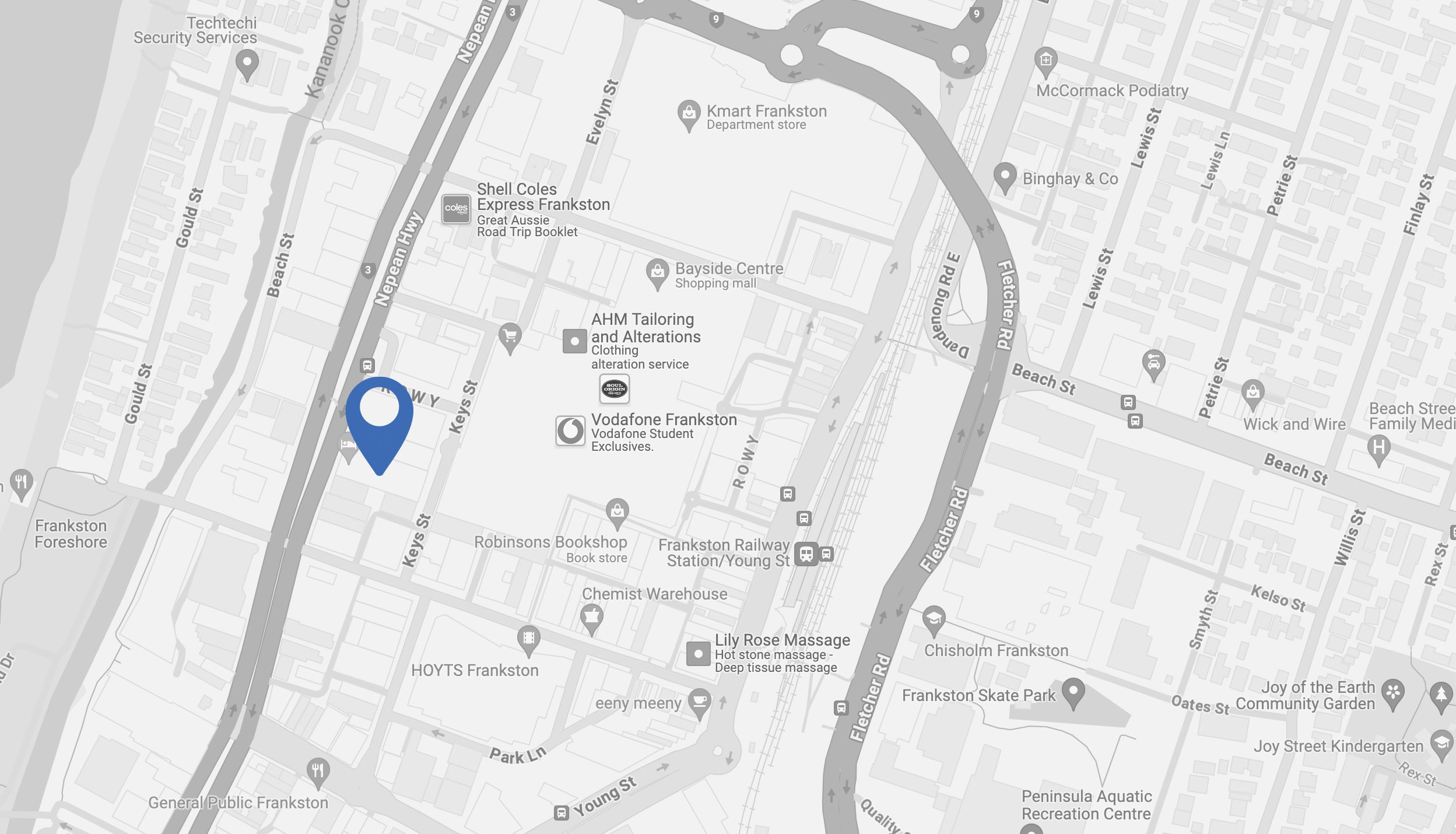

Our process

Step 1 – Initial Discovery Meeting

We begin with a one on one consultation to learn about your financial and lifestyle goals and needs, and how we can support you to achieve them. We will explain the advice process and gather a lot of information to take a comprehensive look at your life and finances.

Once we have an insight into your personal needs, circumstances and objectives we are able to identify the areas of advice that we believe would be beneficial to you and the cost of that advice. At that point you decide if you wish to proceed with the advice process in the areas of advice and cost you are happy with.

Step 2 – Prepare & present your Financial Plan

We undertake research and modelling to create your personalised recommended strategies that will be detailed in your comprehensive financial plan (Statement of Advice).

When your personal financial plan is ready we will hold another meeting to present and discuss with you the Statement of Advice to explain the recommendations, how you achieve your goals and objectives, the advantages, issues to consider, costs, alternative strategies and the modelled projections.

Step 3 – Implementation

When you are comfortable with your financial plan and are happy to proceed, we attend to implementation of the recommendations on your behalf and make adjustments as needed to ensure your plan remains on track and in alignment with your financial goals.

Step 4 – Ongoing Support and Advice

As your financial adviser we will keep you informed about market trends, legislative changes, and investment opportunities, ensuring your financial plan stays on track.

We hold review meetings to assess progress, address changes in your circumstances, and adjust your strategy if need be to ensure it is still aligned with your financial goals.

With our constructed investment portfolios we provide ongoing asset management with ongoing reviews of your investments, making necessary adjustments to capitalise on opportunities and adapt to changing market conditions.